08:41 – Costco run and dinner yesterday with Mary and Paul. Barbara did very well.

If you don’t like to be frightened, turn away now.

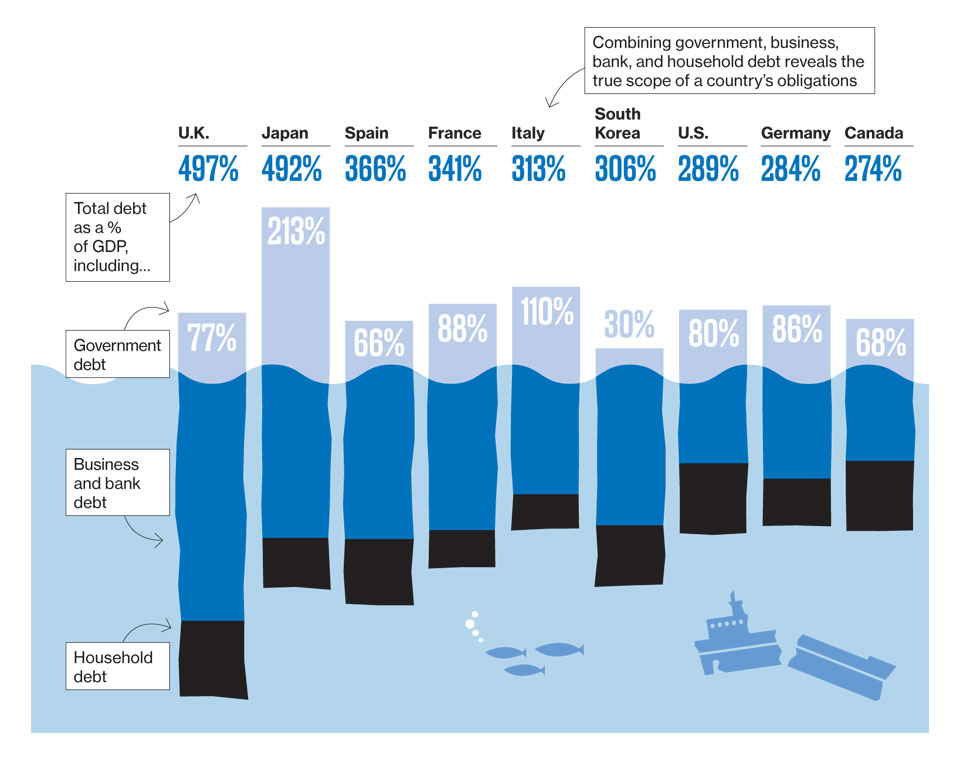

This graphic, from this article, makes clear that sovereign debt, scary as it is, is only a part, often a small part, of the total indebtedness of the world’s major economies.

This graphic, from this article, makes clear that sovereign debt, scary as it is, is only a part, often a small part, of the total indebtedness of the world’s major economies.

Roy Harvey sent me a link to this article by Ambrose Evans-Pritchard, whose work I’ve been reading for years. Although Evans-Pritchard buys into Keynesian arguments a bit too much for my taste, in general he’s one of the few MSM writers who actually gets it. He’s a journalist of the old school, and there aren’t many of them left.

In this article, Evans-Pritchard makes the same argument that I’ve been making for some time now, that the US, although hurting, is set to come roaring back more dominant economically than ever. As he concludes, “The 21st Century may be American after all, just like the last.” Indeed.

09:24 – Oh, yeah. I should have mentioned that these numbers are only for formal contractual indebtedness. What they don’t include is unfunded pension and health-care liabilities, which are often much larger than formal indebtedness. Greece, for example, is usually reported to have sovereign indebtedness totaling 160% of GDP. That’s true as far as it goes, but once one adds in personal and business debt and unfunded pension/health-care liabilities, it’s more like 1600% of GDP. The major economies aren’t quite that bad, but unfunded liabilities at the federal and state levels as well as corporate unfunded liabilities still make formal indebtedness pale.