08:34 – As expected, the Euro is getting hammered this morning. Yields on Spanish and Italian debt have jumped by about 0.2 percentage points already this morning, with worse to come. The EU authorities made a major blunder with their feel-good “stress test” results. They released the actual data, which means that investors could and did plug in their own assumptions and run them against that data. And the results aren’t pretty.

The two major phony assumptions made for the official bank test results were that no sovereign default would occur and that a 5% core capital requirement was sufficient. In reality, of course, there will be a default. In effect, Greece has defaulted already, with Portugal and Ireland teetering on the edge and Spain and Italy not far behind. Even without a default, using a more realistic 7% capital requirement puts the majority of European banks in bankruptcy and a so-called conservative 10% capital requirement puts all of them in deep, deep trouble. With a default, they’re toast.

Meanwhile, the higher yields on Spanish and Italian debt threaten their immediate solvency. For the Italians, for example, a 1% increase in yield costs them about €8.5 billion per year, so it doesn’t take much to wipe out the effects of the recent Italian so-called austerity measures. The EU authorities continue kicking the can down the road, most recently by delaying the crisis summit from last week until Thursday of this week. I was about to say that they’re running out of time, but the truth is that they’ve already run out of time. This will play out now no matter what they do Thursday.

This is devolving into a fight between the richer northern countries, which perhaps not coincidentally are all secular, and the poorer southern countries, which are all Catholic. I think a breakup of the Eurozone is a foregone conclusion, with the richer, productive northern countries refusing to continue to subsidize the poorer, unproductive southern countries. German citizens were never happy about the Euro to begin with, and there is now strong sentiment for abandoning the Euro and returning to the Deutschmark.

Meanwhile, Greece has begun uttering threats, including floating the idea of withdrawing from the Euro. Some threat. Greece reminds me of that scene in Blazing Saddles, where Bart takes himself hostage and threatens to shoot himself in the head unless everyone backs off. It worked for Bart, but it’s not going to work for Greece.

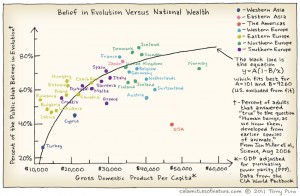

11:10 – Here’s a fascinating graph from Calamities of Nature of GDP versus belief in evolution that makes very clear just how much an outlier the US is.

13:24 – Geez. Talk about inflation. I was ordering some chemicals from one of my suppliers, but the website was misbehaving, timing out and dumping the contents of my cart. So I emailed the purchase order to them and called to follow up. As usual, we got into a discussion about stuff unrelated to the order.

He verified that everything on my list was in stock and ready to ship, but mentioned that he was having terrible problems restocking some chemicals. One of them is silver nitrate. All of his suppliers have plenty of it, but none are willing to sell any because the price of silver just keeps going up and up. And the potassium iodide situation is nearly as bad. Back when the Japanese reactor problem occurred, you couldn’t get potassium iodide for love or money. Every bit of it was being made into KI tablets. Everyone expected sanity to return once the Japanese scare was over, but it hasn’t. Since that event, the price of potassium iodide has literally quadrupled to quintupled, and there’s no relief in sight.

None of that really surprised me, but some of the chemicals in short supply and/or experiencing major price jumps are so commonplace and cheap that I had trouble believing there is actually a shortage. For example, ammonium acetate. Ammonium acetate? Geez. You make the stuff by neutralizing glacial acetic acid with concentrated ammonia, both of which are cheap and available literally by the tanker load, and evaporate the water. There’s no possible way there should be a shortage of ammonium acetate, and yet there is.

14:15 – Oh, my. Things are suddenly even worse, with evidence that the “contagion” is now extending to France and even Germany. The price of CDSs for both nations jumped today, with France jumping from 114 to 123 basis points, and Germany from 60 to 64.

A CDS (credit default swap) is basically an insurance policy against a debtor defaulting, at which point the debt holder is paid the face value and in return signs over the (bad) debt to the CDS issuer. The premium for a CDS is specified in basis points, or one one-hundredth of 1%. Right now, Greece CDSs are at 2500+ basis points, or more than 25%. In other words, insuring €1 billion of Greek debt involves paying premium of €250 million. Does that mean that Greek debt is currently worth 75% of face value? Not at all. The CDS premium reflects the fact that CDS issuers are still expecting some sort of bailout for Greece. Absent that, the current CDS premium on Greek debt would probably be at 9000+ basis points and possibly 9900+ basis points. Essentially no one outside the EU authorities really expects Greece to survive this mess. They’re treating Greece as though it had already defaulted, and rightly so.

The scary thing right now is that CDS prices on French and German debt are increasing substantially. They’re still relatively small, at only a few percent of CDS premiums on Greek debt, but they’re increasing rapidly in percentage terms, and that indicates that investors are at least somewhat concerned about the likelihood of a French or even German default. As someone commented, if investors start looking with concern at France, it’s game over for the Euro.